With all of the holiday cheer now behind us, it’s time to take stock of the year ahead. And while 2013 was a good year for the stock market and a somewhat better-than-recessionary year for the economy as a whole, the ravages of the past twelve months have placed a handful of technology-related companies at a crossroadsâ€"one that could lead to a miraculous recovery, an acquisition, or the sort of corporate undeath that turns them into intellectual property zombies that feed on other companies’ brains for survival.

Earlier this week, we reviewed my questionably accurate picks from last year, and I asked for your feedback on who should make this year’s watchlist. I also consulted with the great minds of the Ars staff for a sanity check and revisited financials and other data just to make sure there was some grounding in fact for the five companies that made my final list. The companies chosen meet at least two of the following criteria:

- An extended period of lost market share in their particular category

- An extended period of financial losses or a pattern of annual losses

- Serious management problems that raise questions about the business model or long-term strategy of the company

None of these criteria are necessarily indicators of future corporate health; companies have been turned around to succeed despite the piling on of these sorts of issuesâ€"companies like General Motors and Chrysler, for example. Of course, none of the companies on our list are likely to receive a federal bailout, either.

So, in no particular order of direness, here are Ars’ five deathwatch companies for 2014:

RadioShack

I never called it “The Shack.†And neither did many of the other people who have shopped at the original tech supply store. But thanks to electronic commerce, some really bad marketing decisions, and a host of other macroeconomic and management land mines, RadioShack is looking very shack-like.

It’s hard to label RadioShack a “tech company,†despite the company’s roots. But this store chain, which sees its core audience as “do-it-yourselfers†and now proudly stocks an assortment of Arduino shields, has been doing it to itself for the past two years after sales started to evaporate in 2011. And the losses are only accelerating. Apparently, stocking radio-controlled trucks did not bring in the foot traffic to help sell more cell phones and batteries. In the first nine months of 2013, the company lost $208.8 millionâ€"$112 million of that in the three months ending in September. A good chunk of the third-quarter loss came as RadioShack purged inventory it couldn’t sell.

Admittedly, RadioShack’s CEO Joe Magnacca has inherited a mess and is trying to undo years of “very ineffective†(his words) strategy. Magnacca came to RadioShack in February from Walgreensâ€"yes, the drug store chainâ€"and has brought on veterans from JC Penney and Under Armour. The company is trying to upgrade its stores to make them hip and fresh and to find a way to draw the technically inclined in with exclusive and limited edition gadgets.

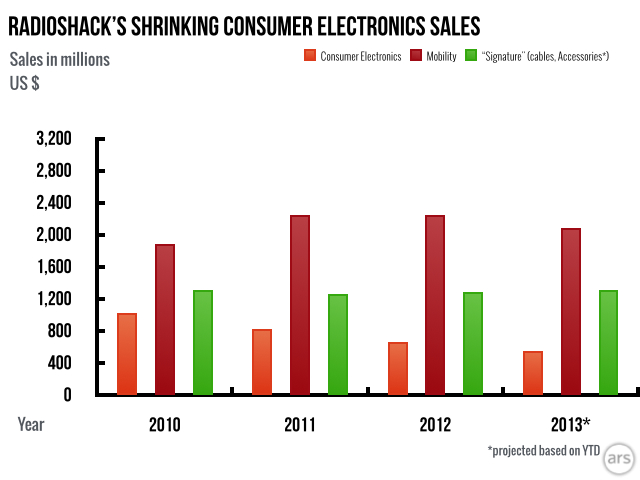

RadioShack's consumer electronics sales have been shrinking. "Signature" got a spike this year thanks to iPhone 5 cables and portable speakers, but everything else sold slower.

That’s probably not enough to fight one simple fact: if you want immediate gratification, you can buy a good deal of what moves at RadioShack at the Walgreens next doorâ€"or the AT&T store next door, or Target, or Best Buy. Or you can just order it onlineâ€"probably at Amazon, because RadioShack’s online presence might as well be on Gopher. But the company is burning through cash trying. Just before Christmas, RadioShack arranged for $635 million in additional financing, adding to its already ballooning debt costs.

RadioShack’s idea of upgrading is apparently (based on a site survey) throwing some Arduino shields in a rack where the speaker wire used to be, improving the lighting, and downsizing from 12 lines of soldering irons to five. And ask a clerk where the soldering irons or Arduino shields are and you’ll get a thousand-yard stare. What RadioShack needs is more than a faceliftâ€"it needs a brain transplant.

BlackBerry

Andrew Cunningham

At the beginning of last year, BlackBerry was poised for a comeback, with a long-delayed new operating system and a line of new phones based on it that were supposed to take on Android and the iPhone head on. The company had everything riding on the new BlackBerry 10 devices and even renamed itself after its flagship productsâ€"dropping the venerable Research In Motion name in an attempt to rebrand and possibly break with the bad juju that had become stuck to it.

I left BlackBerry off of our deathwatch list last year because it seemed like things were looking up just a bit. Then the OS and product launch happened. And after flooding retailers with the new keboardless Z10, the new phones didn’t sell. A comically bad marketing campaign (including a jaw-droppingly bad Super Bowl commercial) did nothing to help, nor did the hiring of Alicia Keys as “creative director.†The company was forced to take a $1 billion loss on unsold Z10 handsets in September. That’s billion, with a “b,†as in BlackBerry.

As the company continued to restructureâ€"slashing 40 percent of its remaining payrollâ€"BlackBerry CEO Thorsten Heins and the board started shopping the company around for sale and eventually tried to cobble together a leveraged buyout to go private like Dellâ€"a strategy that ended up collapsing and costing Heins his job.

BlackBerry is not going to cease to exist, at least not any time soon. Interim CEO and executive chairman John Chen has $3.2 billion in cash to work with, thanks in part to a $1 billion loan-convertible-to-stock by Fairfax, the private equity firm that was supposed to buy the company for $4 billion. Chen is refocusing the company on business customers, pumping up BlackBerry’s position as an enterprise mobile device management software provider, and it's looking to keep the phone business going as a player in its biggest growth marketâ€"Indonesiaâ€"with a manufacturing deal with Foxconn.

But with rapidly diminishing overall sales (down to $11 billion from 2012’s $18 billion) and a $4.4 billion loss for the company’s last quarter ending in November, just how relevant BlackBerry will end up being if it does survive is a huge question mark. Chen and his team are now looking at a future where BlackBerry is facing increasing encroachment on the enterprise front from other mobile device management players, Apple, and Android device makers (Samsung in particular, which now also has permission to play in the sandbox of BlackBerry’s biggest customer, the Department of Defense). Now surpassed in market share by Windows Phoneâ€"with just a 1.7 percent market share in the third quarter of 2013â€"BlackBerry faces a future as a footnote in the mobile device marketplace.

No comments:

Post a Comment