By

Earlier this week, we walked you through the stridently awful Apple Pay alternative being cooked up by Walmart, CVS, Best Buy, and more. It is dumb and bad, but as a recent New York Times report indicates, it's also not going anywhere any time soon. But not because anyone necessarily wants it.

It's

probably helpful to do a quick overview, both because the proceedings

are slightly complicated and because sometimes you can end a great

dumbness just by talking about it over and over again until everyone

realizes just how dumb it is. So! Let's keep talking.

In this corner you have wireless payments, powered by NFC technology, championed by Apple Pay because previous versions (helloooooo Google Wallet)

never took off. These are Virtuous and Good and make your life easier.

In the opposite corner, you have something called CurrentC, a

meaningless (on multiple levels) name given to a horrific payments

system developed by a consortium of major retailers like Walmart, Best

Buy, Target, and CVS. It is Greedy and Dumb and relies on QR codes,

which should tell you most of what you need to know.

Big corporate entities fighting! Boring, right? But here's where you come in.

So long, choice

The

band of big box brothers pushing CurrentC is known as MCX, and has been

around for years now. In fact, while CurrentC won't be implemented

until next year, it's been a known quantity for at least the last few

months. Nobody paid it any mind, though, because there was no need to,

because there are sacks of potatoes with a more compelling narrative.

And

then Apple Pay happened! Apple Pay, which put wireless payment powers

in millions and millions of phones all at once. While Google Wallet and

Softcard had given plenty of Android owners mobile wallets already, it

was the critical mass of iPhone 6 and 6 Pluses marching into McDonald's

that caused a minor panic among the MCX multitudes.

In

the face of a widely adopted payment platform that would make it easier

for their customers to give them money in exchange for goods and

services, CVS and Rite Aid opted to pull the plug on NFC payments in

their stores altogether. No more paying with your phone, at all, until

CurrentC shows up sometime next year.

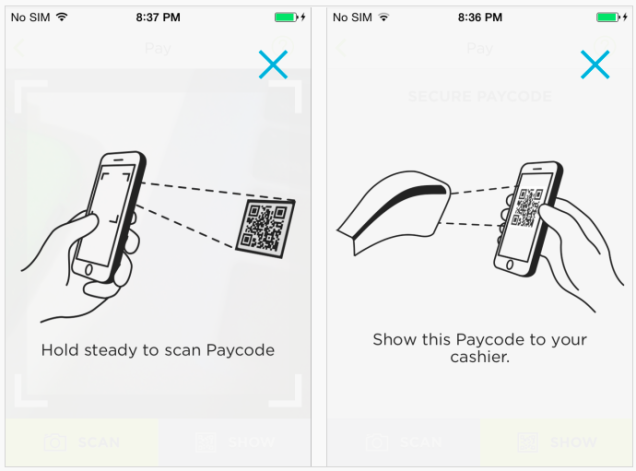

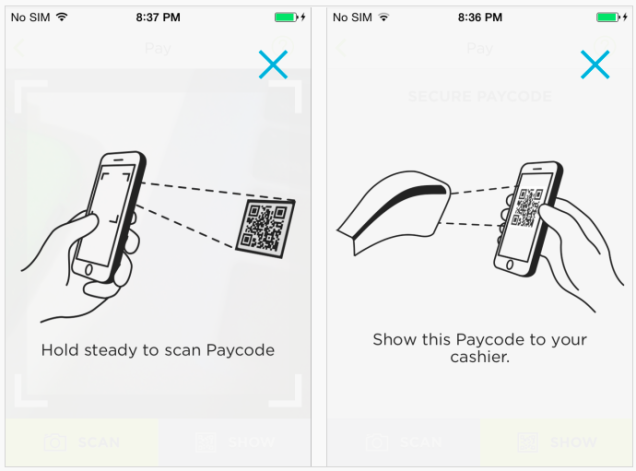

For the visual learners, that means that instead of this:

You will be stuck with this:

This

would be bad enough if it were simply a matter of limiting your choices

out of self-interest. But what makes it unconscionable is that CurrentC

is objectively terrible. Don't believe me? Here are the steps you'll

need to complete a CurrentC purchase:

- Download CurrentC.

- Give CurrentC your bank account information. (No seriously).

- Hand the cashier the items you want to purchase.

- Open up your CurrentC app.

- Open the QR code scanner on your CurrentC app

- Point your phone at the cashier's screen.

- Scan the QR code.

- If the QR code doesn't work, enter a numeric code by hand.

- Just pay with your credit card next time because honestly.

It would be easier to pay for everything by counting out nickels and lining them all on the counter face-up.

Hello, greed

So

why, you might wonder, would a retailer like Target or Rite Aid or any

of them opt for such an anti-consumer product? To make it more difficult

for people to pay, instead of easier? Because money!

While

CurrentC will be terrible for you—or much more likely, just another

thing to ignore at the checkout counter, like Almond M&Ms or Modern

Quilting magazine—it is in theory amazing for the stores behind it. Not

only do they get direct access to your bank information, they get to

push you towards using their own store cards, and away from the credit

card companies that skim a few percentage points off of every

transaction they're a part of. It's a chance for them to push "marketing

communications" to you (opt-out only) and track your location

(likewise).

CurrentC

makes at least a little more sense when you remember that it's been in

the works for years, before Apple Pay was even a glimmer in a rumor

site's eye. At the time, Google Wallet was languishing. The mobile

payments market was wide open. And the retailers themselves weren't yet

associated with some of the biggest financial info breaches of all time.

But

Apple Pay is here now. As is the rightful distrust of the MCX

coalition's ability to keep your info safe (in fact, it just came out

that CurrentC has already been hacked).

If nothing else, at this point there's been enough backlash against

CurrentC that you'd think at least some of the companies involved would

have turned tail by now. But last night's NY Times report

indicates why they're still standing strong in the face of ugh; if they

leave MCX, they'll face fines hefty enough that it's not worth just

letting Apple Pay into their hearts. Not yet, anyway.

In a statement released this morning, MCX denied that fines were involved for leaving MCX. But stalwart NYT reporter Mike Isaac stands by his report.

And there must be at least some disincentive that would make companies

like CVS suffer though such a clusternut; possibly that if you stay with

MCX and use Apple Pay anyway you'll take a hit? It's murky in the way

that PR scrambling always is.

Either

way, it's clear that this isn't a fight that MCX retailers signed up

for so many years ago. And it's hard to imagine that many of them are

excited to stay the course. The longer it takes for the retreat to

start, though, the longer the future of payments will stay stalled out.

Or you could always just shop at Walgreens instead.

No comments:

Post a Comment